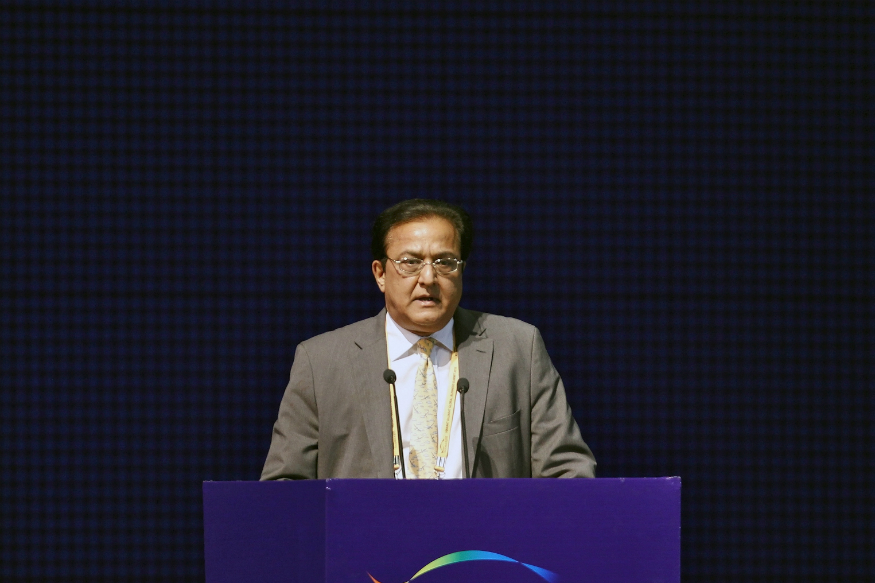

New Delhi: The Enforcement Directorate (ED) on Friday night conducted raids at the Mumbai residence of Yes Bank founder Rana Kapoor in connection with a money laundering probe against him and others, said officials.

The raids came a day after the Reserve Bank of India (RBI) capped depositor withdrawals from the troubled Yes Bank at Rs 50,000 for a month and superseded the board of the private sector lender with immediate effect. Yes Bank will not be able to grant or renew any loan or advance, make any investment, incur any liability or agree to disburse any payment.

This led to panic among customers, with lines forming outside the bank’s ATMs on Thursday night itself — the rush continued through Friday.

The central probe agency registered a case under the Prevention of Money Laundering Act (PMLA) against Kapoor after the raids at his home in Samudra Mahal area.

Kapoor was also quizzed, with sources saying the questioning will continue through the night.

The ED is investigating Kapoor’s role in connection with the disbursal of a loan to a corporate entity and the subsequent alleged kickbacks reportedly received in his wife’s accounts. Some other alleged irregularities are also under the agency’s scanner, added officials.

The case against Kapoor also has links with the DHFL probe as the loans lent by the bank to the company allegedly turned into Non-Performing Assets (NPAs), said the officials, adding other alleged irregularities are also under the agency’s scanner.

Earlier on Friday, the State Bank of India (SBI) said it will pick up a 49% stake in Yes Bank under a government-approved bailout plan, with Finance Minister Nirmala Sitharaman assuring depositors that their money is safe.

A day after imposing a moratorium on Yes Bank, the RBI issued a draft reconstruction scheme for the private sector lender and said the SBI has “expressed its willingness” to make an investment.

Yes Bank has been struggling to raise capital. It sought to raise $2 billion initially during this fiscal, which was then pruned to $1.2 billion as it could not rope in a single investor.

The bank had also deferred the announcement of its financial results for the third quarter ending December. It had told stock exchanges that it will publish the same on or before March 14 this year.

Stocks of Yes Bank plunged by over 80% during intra-day trade on BSE and closed 56.04% down at Rs 16.20 apiece on Friday.