After weeks of market volatility and calls by US President Donald Trump for the Federal Reserve to stop raising interest rates, the central bank instead did it again, and stuck by a plan to keep withdrawing support from an economy it views as strong.

US stocks and bond yields fell hard. With the Fed signalling “some further gradual” rate hikes and no break from cutting its massive bond portfolio, traders fretted that policymakers could choke off economic growth.

“Maybe they have already committed their policy error,” said Fritz Folts, chief investment strategist at 3Edge Asset Management. “We would be in the camp that they have already raised rates too much.”

Interest rate futures show traders are currently betting the US central bank won’t raise rates at all next year.

Wednesday’s rate increase, the fourth of the year, pushed the Fed’s key overnight lending rate to a range of 2.25 per cent to 2.50 per cent.

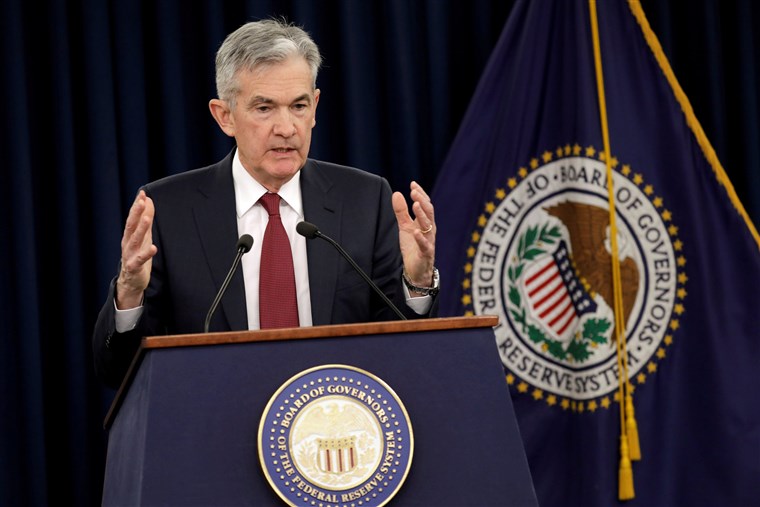

In a news conference after the release of the policy statement, Fed Chairman Jerome Powell said the central bank would continue trimming its balance sheet by $50 billion each month, and left open the possibility that continued strong data could force it to raise rates to the point where they start to brake the economy’s momentum.

Mr Powell did bow to what he called recent “softening” in global growth, tighter financial conditions, and expectations the US economy will slow next year, and said that with inflation expected to remain a touch below the Fed’s 2 per cent target next year, policymakers can be “patient”.

Fresh economic forecasts showed officials at the median now see only two more rate hikes next year compared to the three projected in September.

But another message was clear in the statement issued after the Fed’s last policy meeting of the year as well as in Mr Powell’s comments: The US economy continues to perform well and no longer needs the Fed’s support either through lower-than-normal interest rates or by maintaining of a massive balance sheet.

“Policy does not need to be accommodative,” he said.

In its statement, the Fed said risks to the economy were “roughly balanced” but that it would “continue to monitor global economic and financial developments and assess their implications for the economic outlook”.

The Fed also made a widely expected technical adjustment, raising the rate it pays on banks’ excess reserves by just 20 basis points to give it better control over the policy rate and keep it within the targeted range.

The decision to raise borrowing costs again is likely to anger Mr Trump, who has repeatedly attacked the central bank’s tightening this year as damaging to the economy.

The Fed has been raising rates to reduce the boost that monetary policy gives to the economy, which is growing faster than what central bank policymakers view as a sustainable rate.

There are worries, however, that the economy could enter choppy waters next year as the fiscal boost from the Trump administration’s spending and $1.5 trillion tax cut package fades and the global economy slows.

“I think that markets were looking for more in terms of the pause,” said Jamie Cox, managing partner at Harris Financial Group in Richmond, Virginia.